Federal Reserve and US Stocks

21.10.2024

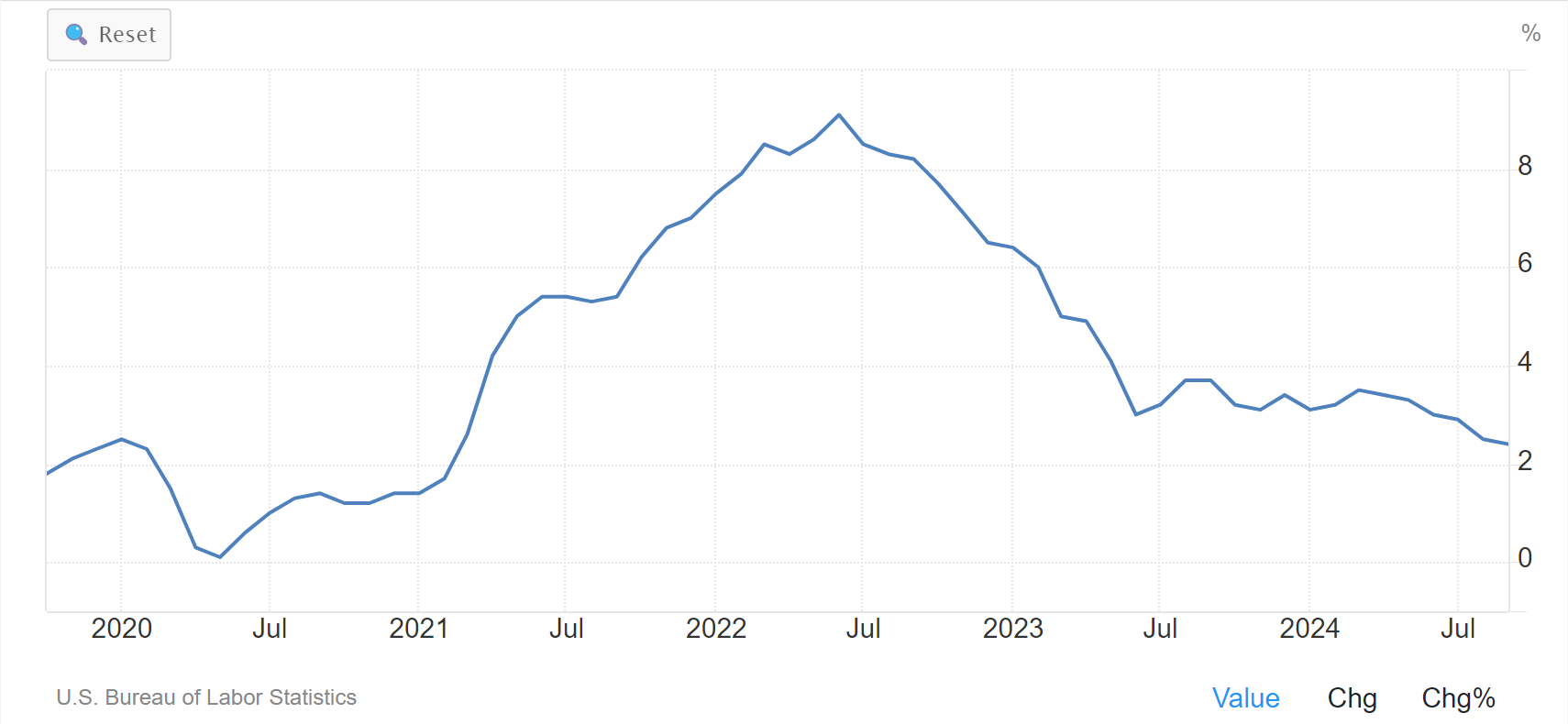

We followed during the previous period that the Federal Reserve cut interest rates for the first time since March 2022 by 50 points, after interest rates rose to 525 points, through the tightening policy followed by the US Federal Reserve in the previous period, where the interest rate in March 2022 was 25 points, or 0.25%, and reached 5.5% until August 2024, and at the last meeting of the US Federal Reserve, it cut the interest rate by 50 points last September, for fear of a recession in the U.S. economy. This significant rise in the interest rate came as a result of the high inflation rates, which reached their highest level in July 2022 at the level of 9.1%, and then began to decline until it reached in its last reading at the level of 2.4%, which encouraged the Fed to reduce the interest rate and ease the strict policy followed.

Looking at the impact of both interest rates and inflation on the economy theoretically, we find that high interest rates have negative effects on the growth of the economy because the interest rate is the cost of borrowing and therefore there is an inverse relationship between high interest and economic growth, and therefore with the tendency to reduce the interest rate, consequently leads to reducing the cost of borrowing, which raises the appetite of investors, and therefore theoretically, we find that reducing interest rates has a positive impact on the growth of the economy and the recovery of markets.

As for inflation, it may lead to a rise in the profits of future companies, due to the high prices of goods and services, and therefore we find that the relationship between inflation and the stock market is positive.>

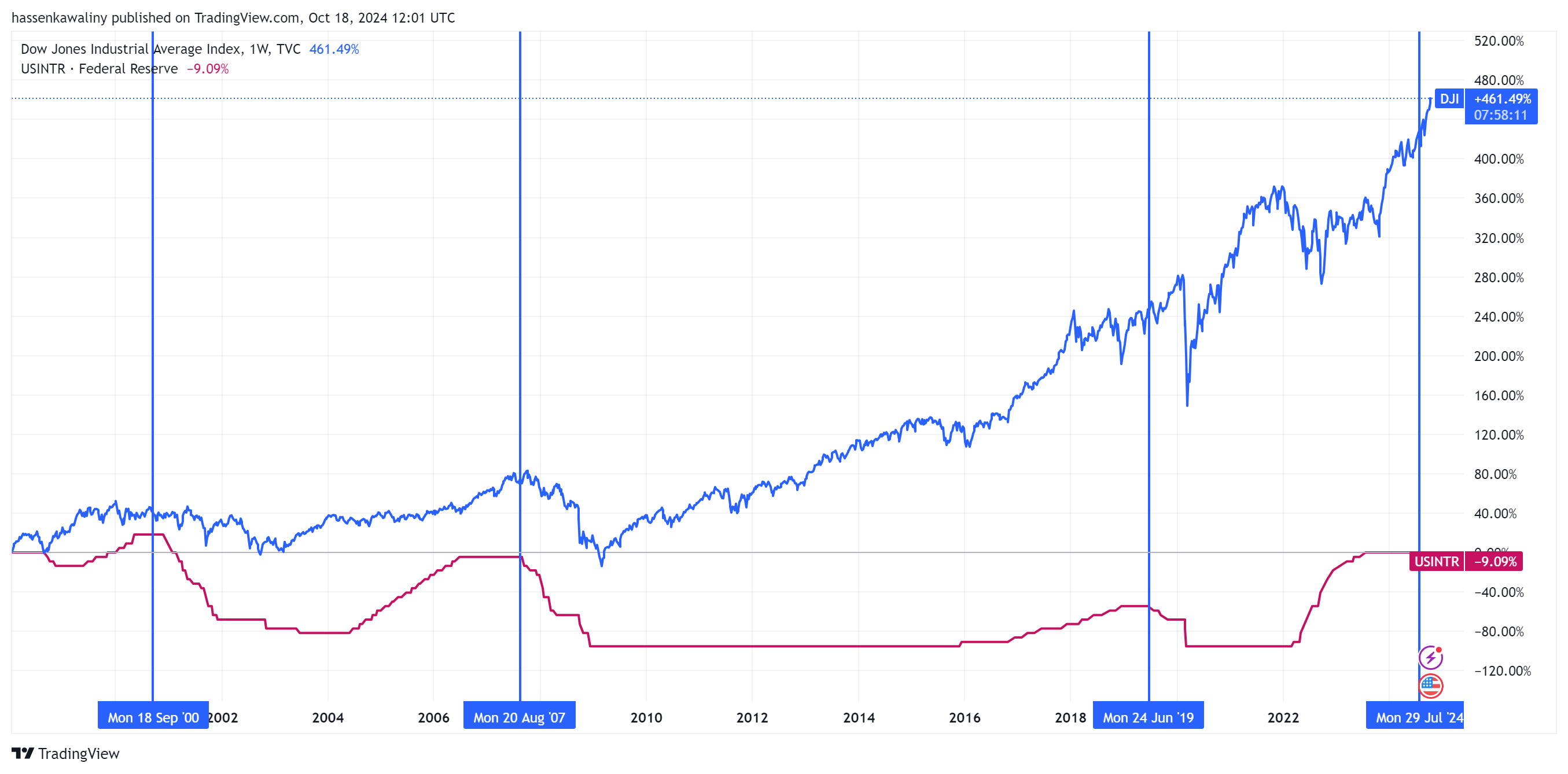

Looking at interest rates and the Dow Jones index, we note a positive relationship between interest rates and the stock market, where back to the first quarter in 2000, we find that the Dow Jones index formed a peak at the level of 11770 with interest rates forming a peak at the level of 6.5%.

Also, looking at the end of the third quarter in 2007, we find that the Dow Jones index peaked at 14100, with interest rates forming a peak at 5.25%.

At the end of the second quarter of 2019, interest rates formed a peak at the level of 2.5%, followed by the Dow Jones index with a peak at the beginning of 2020, reaching the level of 29,500

Looking at the current situation, we find interest rates formed a peak at the end of the third quarter of this year, which may indicate that the Dow Jones formation is approaching its peak.

Will history repeat itself again and soon see the formation of a new peak for the Dow Jones?